The web site you have selected is an external site not operated by Horizon Bank. This link is provided for convenience and informational purposes only and Horizon does not endorse and is not responsible for the content links, privacy policy or security policy of this website or app you are about to visit. Horizon Bank is not responsible for (and does not provide) any products, services or content for this third-party site or app, except for products and services that explicitly carry the Horizon Bank name. Click Proceed to continue or Cancel to go back.

Deposit Checks Anywhere, Anytime

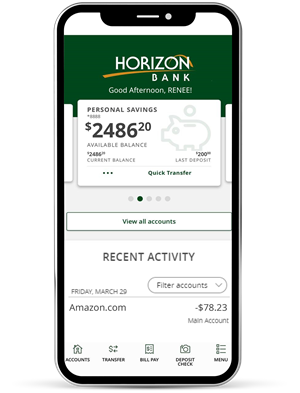

Horizon Bank Mobile Deposit allows you to deposit checks anywhere, anytime, using your mobile device with the Horizon mobile app. Saving you time without the need to visit a branch or ATM.

Enable Mobile Deposit

- Log in to Online Banking from your desktop or the Horizon Bank app

- Click Services & Settings, Mobile Deposit Enrollment

- Accept the Mobile Deposit Agreement

- Download the app to deposit checks remotely

How to Deposit a Check

Have your check ready by signing the back and write “for Mobile Deposit Only Horizon Bank”.

- Log in to the Mobile App

- Select Deposit Check from menu at the bottom

- Follow the on-screen instructions

- Tap Submit Deposit

We’ll notify you once we’ve received your deposit. It’s that simple.