Fresh Start Checking

Fresh Start Checking is perfect for you if you're looking to leave past checking account problems in the dust. A new start with a Fresh Start Checking Account means you have overdraft forgiveness and a minimal monthly service charge. It's everything you'll need to get back on track with everyday banking – along with a complementary savings account at no added charge.

- $25 minimum opening balance

- $5 monthly service charge

- Free eStatements or a $2 paper statement charge

- Debit Card transaction daily limit is $500, ATM daily limit is $200

- Overdraft and NSF fees are waived

- Complementary Everyday Savings Account

Checking Benefits and Conveniences

-

No-Fee ATMsAccess your cash at thousands of fee-free MoneyPass ATMs coast-to-coast. Just look for the MoneyPass logo.

No-Fee ATMsAccess your cash at thousands of fee-free MoneyPass ATMs coast-to-coast. Just look for the MoneyPass logo.

-

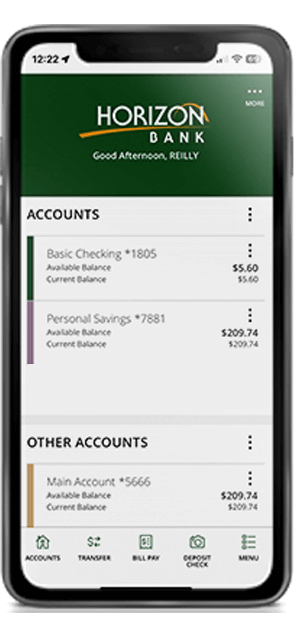

Mobile BankingSecure access to check balances, pay bills, transfer money, and set up account alerts. Download our mobile app and stay connected from anywhere.

Mobile BankingSecure access to check balances, pay bills, transfer money, and set up account alerts. Download our mobile app and stay connected from anywhere.

-

Mobile Check DepositDeposit checks using your phone or tablet app.

Mobile Check DepositDeposit checks using your phone or tablet app.

Download the mobile app. -

Digital WalletLink your debit card to your phone using Apple Pay, Google Wallet or Samsung Pay®

Digital WalletLink your debit card to your phone using Apple Pay, Google Wallet or Samsung Pay®

Get started with your account.

-

Set up your Account

Activate your debit card, fund your account, set up direct deposit, create online credentials and download our mobile app with these easy-to-use resources.

-

Use Your Account

Maximize your account experience by setting up online bill pay, scheduling automatic payments, and other handy features.

-

Kickstart your Savings when you Enroll in Easy Save!

Round up each debit card purchase to the nearest dollar to turn your change from everyday purchases into savings.

The change from your debit card purchases is accumulated and automatically transferred daily from your checking account to your savings account.

The web site you have selected is an external site not operated by Horizon Bank. This link is provided for convenience and informational purposes only and Horizon does not endorse and is not responsible for the content links, privacy policy or security policy of this website or app you are about to visit. Horizon Bank is not responsible for (and does not provide) any products, services or content for this third-party site or app, except for products and services that explicitly carry the Horizon Bank name. Click Proceed to continue or Cancel to go back.