The web site you have selected is an external site not operated by Horizon Bank. This link is provided for convenience and informational purposes only and Horizon does not endorse and is not responsible for the content links, privacy policy or security policy of this website or app you are about to visit. Horizon Bank is not responsible for (and does not provide) any products, services or content for this third-party site or app, except for products and services that explicitly carry the Horizon Bank name. Click Proceed to continue or Cancel to go back.

EnFact Debit Card Fraud Protection

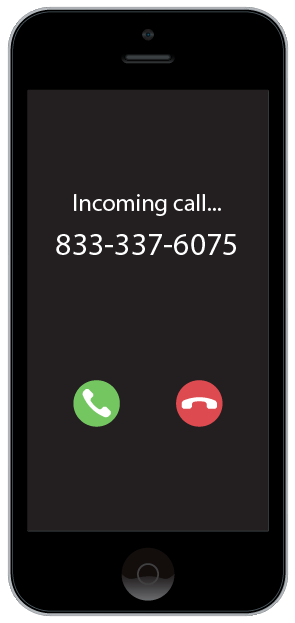

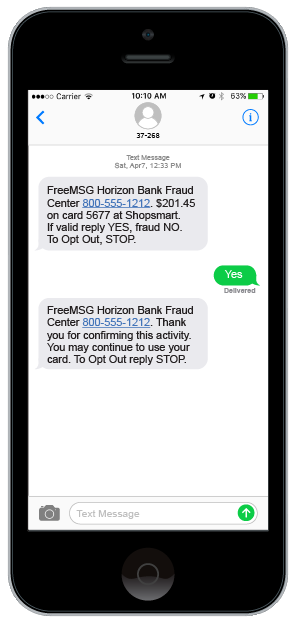

EnFact, our fraud monitoring system, is constantly working to detect suspicious activity on your debit card. When suspicious activity is detected, EnFact will contact you to verify pending transactions via phone call, email, or text message. This quick detection of unusual activity provides you with an extra layer of security, so you can rest assured we’ve got you covered. It's important to respond to these notifications so that we can work together to keep your accounts secure.

EnFact FAQs