Five Ways to Boost Your Credit Score Starting Now

Being denied a loan for a home or a car can feel like a punch in the gut. But no matter why you don’t qualify for the best APR, or how long your credit

has been less than ideal, all is not lost.

There are strategies you can use to begin building your credit back up. Yes, it may require some time and lots of patience

on your part, but you won’t regret the effort. Here are a few suggestions to bump up your credit starting now.

Do These to Build Better Credit and Enjoy Lower Rates

Get your credit report.

Knowledge really is power. You are entitled to a free credit report and score any time you like through

Credit Advisor. Pulling your own credit information — which is like a report card for how you handle money — won’t impact your score. It’s also a good

idea to request one report from a different bureau (Experian, Equifax, and TransUnion) every four months so you can make sure there are no errors showing up on individual reports. Get these for free at AnnualCreditReport.com.

If you see anything on a report that’s not correct, report it. About 20% of all credit reports have mistakes, so you need to scour the document to ensure everything is accurate. A mistake could mean a lower score, even if you did nothing wrong.

As the global pandemic led to job losses and other financial hardships, the Federal Trade Commission has noted an increase in credit report errors reported by consumers.

Automate your payments to avoid late fees (and a lower credit score).

Your credit score is largely based on your payment history, counting for about 40%. Scores range from 300 to 850, with higher being better. Even one late payment on a credit card can lower your score by as much as 100 points. That’s huge. And that’s

why it’s so important to pay your bills on time, or even early, every single due date.

One way to do this is to use online banking and set up automatic payments. Set up electronic calendar reminders on your smartphone, tablet, or laptop

to help nudge you to pay your bills a day or so early. If you are old-school, put a big red dot on the paper calendar in your kitchen or office, tape a note to your bathroom mirror or find some other clever way to remember.

Pay down debt, then stay low.

Lenders don’t want to see sky-high balances on their credit cards. That means paying down balances if you’re carrying them — and then refrain from maxing out your cards if you can help it. Owing more than 30% of your credit limit can

be a red flag to those in the money-lending business. You should instead aim to use between 10% and 30% of the total credit you have.

Use your credit or lose it.

If you stop using a credit card for six months or longer, your credit card issuer could cancel the account, and that could hurt your credit score. If it was the card you held for the longest period of time, that’ll hurt your score more, because

the longer your relationship with your lender, the better it is for your score. To keep an unused card current, make a small purchase once a month then immediately pay the bill.

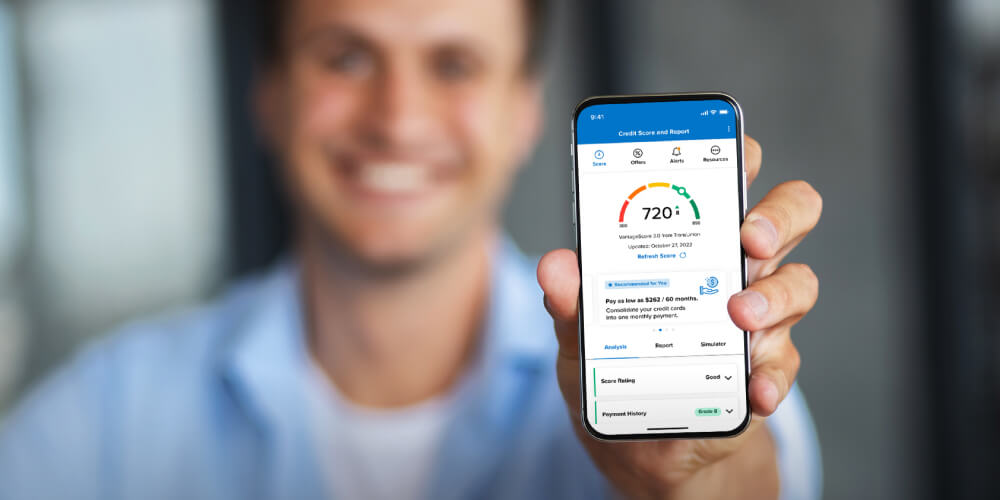

Monitor your credit score

A good credit score may mean you have easier access to more credit, and at lower interest rates. The consumer benefits of a good credit score go beyond the obvious. For example, underwriting processes that use credit scores allow consumers to obtain credit much more quickly than in the past.

Horizon offers customers a great tool to stay on top of your credit report called CreditAdvisor. All customers with Online Banking can enroll for free from the menu of your online account. Your credit score will automatically update every 7 days, or you can click ‘Refresh Score’ to update your report every 24-hours. Enroll for free today!