Amplifying Your Retirement Savings Through the Power of Tax-Deferral

.png?sfvrsn=6fe85077_1)

In today's complex financial landscape, strategic tax planning is crucial, particularly when it comes to building a robust retirement nest egg. At Horizon Private Wealth Management (HPWM), we often emphasize the indispensable role of tax-deferred retirement accounts, which include options like 401(k)s and Individual Retirement Accounts (IRAs).

The Strategic Advantage of Tax-Deferral

Tax-deferral isn't just a postponement of your tax obligations; it's a purposeful financial strategy designed to provide growth that is potentially free from current taxation. By directing your investment capital into tax-deferred accounts, you are not only delaying the inevitable tax outlay but also perhaps reducing the overall tax burden over the course of your financial lifecycle.

The Interplay of Tax-Deferral and Compound Interest

Compound interest is a well-understood principle of investment growth. The magic happens when the interest generated by your initial investment is reinvested, creating a cyclical pattern of escalating gains. The symbiotic relationship between this compounding effect and tax-deferral can significantly amplify your long-term returns.

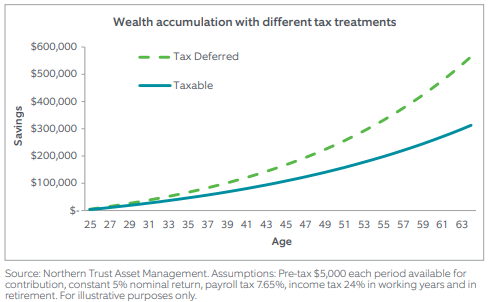

To articulate this interplay, consider a hypothetical scenario where a 25-year-old individual invests $5,000 annually. Assuming a 5% annual return and a uniform tax rate of 24%, over a span of 40 years, a standard taxable account would appreciate to $312,787. However, a tax-advantaged retirement account would catapult to an eye-opening $564,765. Post-tax, the latter would net you $429,222, providing a considerable benefit of $116,434 more than the taxable account.

Optimizing Your Tax Bracket in Retirement

The advantages of tax-deferral could extend even further if you find yourself in a lower tax bracket upon retirement. In the example above, the individual maintains a consistent 24% tax bracket. If this tax rate drops to 22% during retirement, the after-tax value of the tax-advantaged account escalates to $440,517, which is a 40% improvement over the taxable account's value. Should the tax rate plummet even further to 12%, the after-tax value would soar to an incredible $496,994, representing a 59% advantage.

The Amplifying Effect of Higher Returns

Higher market returns further compound the advantages of tax-deferral. If the market delivers a 6% return, instead of 5%, the value of the taxable account could increase to $375,318, a 20% improvement. Meanwhile, the tax-deferred account would swell to $551,253, marking a 28% gain over the previous scenario. Clearly, the efficacy of tax-deferral cannot be understated.

It's Never Too Late to Leverage Tax-Deferral

The strategic benefit of tax-deferral is universally applicable, not restricted to early-stage investors. Take, for instance, someone who commences their savings journey at age 45. With all other factors held constant, by age 65, the tax-deferred account would have accrued to $154,591 compared to the taxable account's $100,627. This illustrates a 17% advantage, which, although not as dramatic as the younger saver's benefits, is still a substantial financial uplift.

Source. Northern Trust Asset Management. Assumptions: Pre-tax $5,000 each period available for contribution, constant 5% nominal return, payroll t ax 7.05%, income tax 24% in working years and in retirement. For illustrative purposes only.

The Multiplier Effect of Tax-Deferral and Compounding

The advantageous nature of compound interest alone can create a strong financial foundation for retirement. However, when it's coupled with a tax-deferred account, the end result is a powerful synergy that can help you accumulate a significantly larger retirement fund. At HPWM, we go beyond mere asset management. Through our consultative approach, we provide comprehensive retirement solutions that consider the tax implications of your investments, enabling you to make informed decisions that align with your long-term financial objectives.

For more tailored advice on how tax-deferral can benefit your financial planning, reach out to our team of experts at Horizon Private Wealth Management.