Celebrating 150 Years of Strength, Stability and Resilience

Time Tested

Horizon has been in business for 150 years and it has survived over 30 economic downturns, from the Great Depression, the rapidly rising interest rates of the early 1980s, and the Great Recession to the current environment. Our long-term business

philosophy of serving local businesses and individuals, and providing loans to qualified borrowers, has helped the bank, its shareholders, and its customers weather these economic storms.

Solid Financial Performance

Horizon continues to prosper as demonstrated by solid earnings in each of the last 20 years. In addition, Horizon has paid uninterrupted dividends on its common shares for over 30 years.

Sensible Advice

Horizon has a long history of helping people through tough times. We listen and seek to provide sensible advice. We recognize that a business or family’s financial stability can change quickly. Therefore, we encourage our customers, and

non-customers alike, to talk with us about ways we may be able to help.

Experienced Leadership

Our management team, both executive leadership and Regional/Market Presidents, consist of seasoned officers, many of whom have weathered several economic downturns. We feel confident in our ability to navigate today’s financial challenges.

Solid Capital Position

Horizon is well-capitalized as defined by all regulatory guidelines.

Diversified Business Model

Horizon’s business model is well diversified across its multiple business lines of commercial, consumer, wealth management, and mortgage. Additionally, Horizon's customers are geographically diverse across our 70+ locations in Indiana

and Michigan. The Bank is not highly concentrated in any one specific business vertical, and we have no exposure to high-risk segments such as cryptocurrencies.

Local Decision Making

All decisions impacting our customers are made locally, rather than by a corporate entity hundreds or thousands of miles away. We provide one-on-one, face-to-face consultations to see how we can help our customers.

Diligent Risk Management

Horizon’s loan portfolios have historically performed better than the overall banking sector during various economic cycles, and we expect this trend to continue.

Reinvestment in our Communities

Because we are a local company, we reinvest our profits locally. We also contribute extensively to local not-for-profit organizations through both volunteer work and contributions. Horizon encourages employees to volunteer with organizations

that have special meaning for them. As a result, more than 500 organizations throughout our region have benefited from these efforts.

Continued Growth

Horizon Bank is one of the area’s largest employers in the northwestern Indiana and southwestern Michigan area with over 900 advisors living and working in the communities we serve and call home. We continue to expand our services into

additional communities throughout Indiana and Michigan – bringing more jobs to the area and giving more consumers the opportunity to bank locally.

Customer Deposits Are Safe

Horizon’s deposits are insured by the FDIC for up to $250,000 per depositor for each ownership category with additional ways to get even more FDIC coverage for deposit accounts. No depositor has ever lost a penny of insured deposits since

the FDIC was created in 1933. (See www.fdic.gov)

Expanded FDIC Insurance Program Available

Horizon also offers multi-million dollar FDIC deposit insurance coverage programs known as CDARs & IFS for large depositors.

Indiana Municipal Deposit Insurance Fund

Indiana has a deposit insurance reserve for municipalities, in addition to the FDIC insurance, which provides additional cushion for our local Indiana municipalities.

Celebrating an incredible milestone.

We take great pride in commemorating our 150 years of service as a prominent Midwest Community Bank in Indiana and Michigan. Since 1873, we have been dedicated to delivering exceptional service and practical guidance. The passion and purpose that exist within our institution are truly unparalleled.

Charitable Giving.

We believe that actively participating and contributing is the most effective approach to understand the needs of our customers and community members. Our Advisors actively participate in endeavors that ignite their passion and hold significance, making a meaningful impact.

Dedicated to Diversity & Inclusion.

In 2021, we introduced Advisor Resource Group with the aim of fostering diversity and inclusion across our organization. Here are some of our Voices of Pride LGBTQIA+ Advisor Resource Group members supporting

the Kalamazoo, Michigan Pride Event.

Invested in our Communities.

Over the last year, our Advisors volunteered with over 530 non-profit organizations! This spring, a team from our Gaylord, MI location spent the day volunteering at the Otsego County Food Pantry.

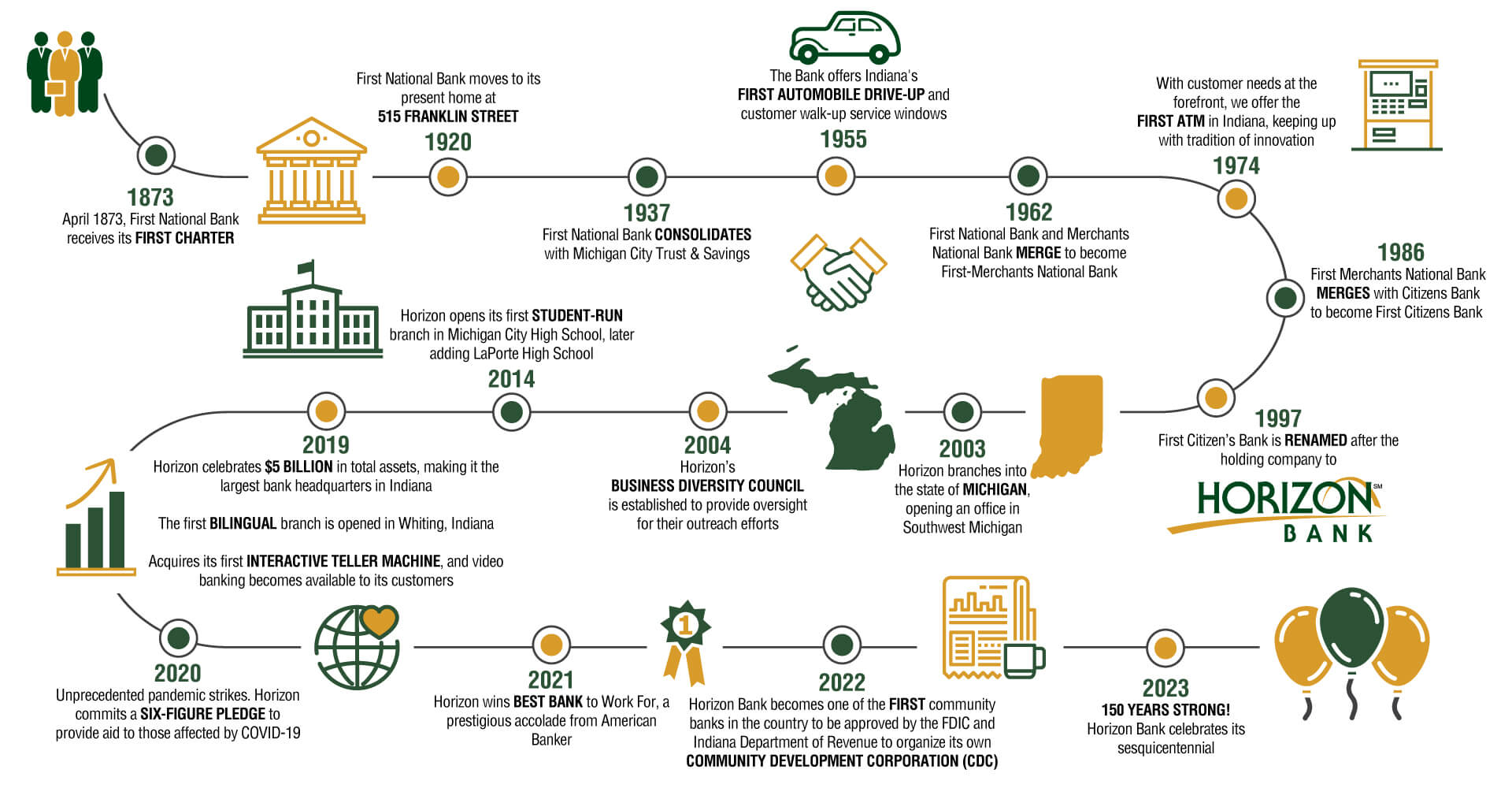

The Road to 150

- 1873April 1873, First National Bank receives its first charter

- 1920First National Bank moves to its present home at 515 Franklin Street

- 1937First National Bank consolidates with Michigan City Trust & Savings

- 1955The Bank offers Indiana's first automobile drive-up and customer walk-up service windows

- 1962First National Bank and Merchants National Bank merges of to become First-Merchants National Bank

- 1974With customer needs at the forefront, we offer the first ATM in Indiana, keeping up with tradition of innovation

- 1986First National Bank Merges with First Bank to become First Citizens Bank

- 1997First Citizen’s Bank was renamed after the holding company to Horizon Bank

- 2003Horizon branches into the state of Michigan, opening an office in Southwest Michigan

- 2004Horizon’s Business Diversity Council is established to provide oversight for Horizon's outreach efforts

- 2014Horizon opens its first student-run branch in Michigan City High School, later adding LaPorte High School

- 2019Horizon celebrates $5 Billion in total assets, making us the largest bank in Indiana. The first bilingual branch is opened in Whiting, Indiana. Acquires our first Interactive Teller Machine, and video banking becomes available to our customers

- 2020Unprecedented pandemic strikes. Horizon commits a six-figure pledge to provide aid to those affected by COVID-19

- 2021Horizon wins Best Bank to Work For, a prestigious accolade from American Banker

- 2022Horizon Bank becomes one of the first community bank in the country to be approved by the FDIC and Indiana Department of Revenue to organize its own community development corporation (CDC)

- 2023150 YEARS STRONG

Horizon celebrates its sesquicentennial

The Road to 150

The web site you have selected is an external site not operated by Horizon Bank. This link is provided for convenience and informational purposes only and Horizon does not endorse and is not responsible for the content links, privacy policy or security policy of this website or app you are about to visit. Horizon Bank is not responsible for (and does not provide) any products, services or content for this third-party site or app, except for products and services that explicitly carry the Horizon Bank name. Click Proceed to continue or Cancel to go back.