Our experts will find the mortgage that's right for you

As leaders in the mortgage industry, we have a variety of loans available and mortgage experts ready to match you with your ideal plan, including conventional fixed/adjustable rates, Jumbo, FHA, construction loans, and more.

Manage Your Loan Application

-

Apply for a Home LoanWhen you’ve found the perfect home, our expertise and exceptional service will streamline the process for you. Click here to apply now.

Apply for a Home LoanWhen you’ve found the perfect home, our expertise and exceptional service will streamline the process for you. Click here to apply now.

-

RefinanceLower your interest rate or monthly payment, shorten the term of your loan, or get cash out to pay off debt or for that project, you have been planning. Click here to apply.

RefinanceLower your interest rate or monthly payment, shorten the term of your loan, or get cash out to pay off debt or for that project, you have been planning. Click here to apply.

-

Build or Renovate with a Construction LoanRenovate your existing home or build a new one with a construction loan. Click here to apply now.

Build or Renovate with a Construction LoanRenovate your existing home or build a new one with a construction loan. Click here to apply now.

Find the Best Rates with our Mortgage Research Tools

-

Calculate Your Payment

Want to know what you can afford?

Use our calculator to find the best rate for your budget! -

Check Today's RatesLooking to compare rates?

We offer competitive interest rates and personal service.

Local Expertise

The key to financial success can often come down to the knowledge, experience, and ability of the team of advisors right in your backyard.

Personalized Mortgage Options

Horizon Bank’s experienced Mortgage Advisors will help you navigate all of your loan options to find the right choice for you and your family.

Dedicated Service

With personalized service and straightforward solutions, Horizon Bank provides dedicated mortgage loan advisors and support teams from start to finish.

Community Loan Programs

Government Loan Options

Conventional Loan Options

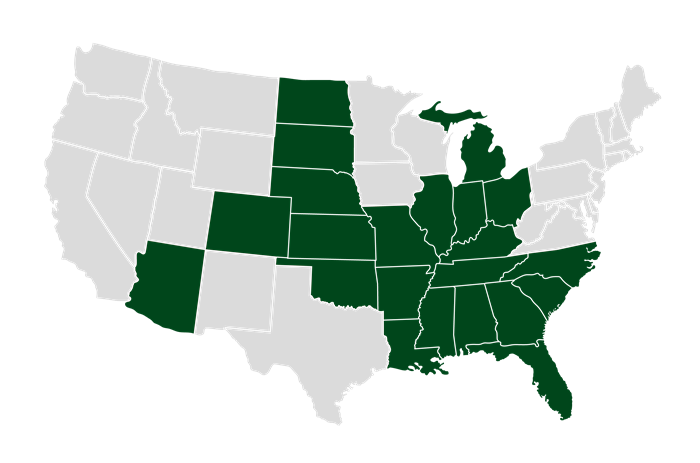

We Offer Loans All Across the Country

Mortgage loans offered in these states

- Indiana

- Michigan

- Alabama

- Arizona

- Arkansas

- Colorado

- Florida

- Georgia

- Illinois

- Kansas

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Nebraska

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- South Carolina

- South Dakota

- Tennessee

Make a loan payment

-

Pay Online

Pay OnlineLog in to online banking to make your payment from your Horizon account or from an external account outside Horizon.

-

Loan Pay Portal

Loan Pay PortalMake fast one-time payments using Horizon's self-service loan portal.

(cannot be used for business payments) -

Video Banking Location

Video Banking LocationUse one of Horizon's Video Banking locations. Video banking machines have extended hours and combine the service of a Horizon advisor with the convenience of an ATM.

Sensible Advice

The web site you have selected is an external site not operated by Horizon Bank. This link is provided for convenience and informational purposes only and Horizon does not endorse and is not responsible for the content links, privacy policy or security policy of this website or app you are about to visit. Horizon Bank is not responsible for (and does not provide) any products, services or content for this third-party site or app, except for products and services that explicitly carry the Horizon Bank name. Click Proceed to continue or Cancel to go back.